Your legacy gift ensures that hope will always endure. It’s one of the most important things you can do for not only your future but the future of countless others.

Leave a powerful impact that will forever build community, grow hope and support change

Transfer Stock & Securities Form

In partnership with Advisors with Purpose

-

Meet Patricia

Meet Patricia, a legacy donor at The Mustard Seed. She’s giving a legacy gift in memory of her husband.

Patricia is 85 years old. Her husband was a dedicated volunteer at The Mustard Seed, and she’s giving a legacy gift because of him.

“It’s honoring my husband’s memory and the interest that he had in The Mustard Seed,” she says. “I know that [The Mustard Seed is] one of those organizations at the grassroots level doing great work.”

For Patricia, legacy giving is a way to give people in need a second chance in life.

“I know what it’s like to not have very much, and that lesson in life sticks with you. You want to give a hand up to people that need it the most when you can, and if you can,” Patricia says.

“I would hope that every single person in this country has a place they can call home. If people have a home, they have an anchor, and they can move ahead.

The Mustard Seed holds a very real purpose in this.”

-

What is Legacy Giving?

Legacy giving can be one of the most fulfilling gifts you will ever make. Anyone can make a legacy gift and you can get started on creating your impact, today.

A legacy gift is a perfect way for you to address your personal financial goals and at the same time, provide hope for today, tomorrow, and forever for the homeless, hungry, and

hurting in your community. Legacy giving also enables you to leave a generous gift for your loved ones; it doesn’t have to be one or the other! -

How to Make a Planned Gift

1. Contact The Mustard Seed Contact Centre at 1-833-GIV-HOPE (448-4673) to get connected with one our our legacy advisors for more information. We can provide you with sample language for bequests or information about programs and services you can dedicate your gift to.

2. Contact your attorney or your financial advisor. Let them know you are considering a legacy gift to The Mustard Seed. They can assist you in determining what type of gift best suits your personal and financial circumstances.

-

Who is Advisors with Purpose?

Advisors with Purpose are a part of the family of ministers of Financial Discipleship Canada and because of the partnership they offer planning giving specialists at no cost, who can help you think through your decisions regarding your estate and ensure that your estate plan and Will reflects you life, faith and values.

How is works at a glance

- Connect with Advisors with Purpose directly by email at [email protected] or phone 1-866-580-9319

- You set up a meeting with an Estate Advisor who will meet with you by phone to discuss your situation, ask key questions and help you consider some options

- The Advisor creates a personal plan for you and sends it to you for review. No two are the same and they are based on the information you provide during the meeting

- Once you have reviewed the plan on your own you set up another meeting with the advisor to go over the plan, ask questions, discuss options and make decisions

- You would then meet with your own lawyer and/or financial professional to create the Will or implement the decisions

Ways to Make a Legacy Gift (Types of Bequests)

-

Gift in Your Will

A will is the cornerstone to any estate planning. It’s also the last communication that you will have with your family and loved ones and it gives you the opportunity to reaffirm your priorities and values.

WAYS YOU CAN LEAVE A GIFT IN YOUR WILL:

• Leave a specific dollar amount

• Leave a residual bequest ‒ a share of the remainder of your estate after other needs are met

• Leave a contingent bequest ‒ a share of your estate after your other beneficiaries have passedTHE BENEFITS:

• You can make a larger gift than you ever thought possible

• A gift in a will doesn’t cost you anything now

• A gift in a will doesn’t have to take away from what you plan to leave for loved ones

• You reduce the tax burden on your estate

• You can choose to make changes to your will at any time -

Gift of Stock and Securities

When you donate publicly traded stocks, mutual funds, and other securities directly to a registered charity, you pay no capital gains tax and receive a tax receipt for the full amount of the gift. The tax receipt is issued for the market value of the assets on the day it is transferred to The Mustard Seed.

-

Gift of Life Insurance

With a relatively low personal investment, a large gift that will help the most vulnerable population, can be given when you name The Mustard Seed as the beneficiary and owner of a new or an existing life insurance policy. Any cash value attributed to the policy will be treated as a gift of cash and will result in a tax credit for the cash value amount.

-

Gift of Real Estate

With proper planning, property or real estate can be donated to The Mustard Seed, resulting in significant tax benefits while providing a generous gift to support our mission.

-

Gift of RRSPs and RRIFs

The funds left in RRSP or RRIF can be used to make a lasting impact by naming The Mustard Seed as the beneficiary of these accounts. A tax receipt for the full amount of the charitable distribution will be issued to the estate to help offset taxes with this tax credit. With this option, you can retain ownership of the RRSP or RRIF and name the charity as the beneficiary only. This option also keeps the asset out of the estate and any consequent claims and probate fees.

Why Give a Legacy Gift to The Mustard Seed?

• Give someone a chance at a better life

• Support a specific city, program, or service that is close to your heart

• Make an enormous impact on a cause that’s important to you

• Minimize tax and maximize gifts to your beneficiaries

• Motivate and encourage

Sample Bequest Language

We hope the following information will help you and your advisors craft an estate plan that is right for you. To include The Mustard Seed in your will, living trust, or retirement account, your attorney may find the following language helpful:

1. Sample wording for a legacy gift without restrictions:

“I hereby give, devise, and bequeath ___________ (a dollar amount, or all or a percentage of the rest, residue, and remainder of my estate) to The Mustard Seed Foundation located at 102 11 Ave SE, Calgary AB T2G 0X5, for its general purposes.”

2. Sample wording for a legacy gift to a specific project/program:

“I hereby give, devise, and bequeath ___________ (a dollar amount, or all or a percentage of the rest, residue, and remainder of my estate) to The Mustard Seed Foundation located at 102 11 Ave SE, Calgary AB T2G 0X5. I direct these funds be used to support ___________ (a priority project; The Wellness Centre, Family Housing Project, Shelter roof repair, etc.) at the time my bequest is realized.”

Transfer Stock & Securities Form

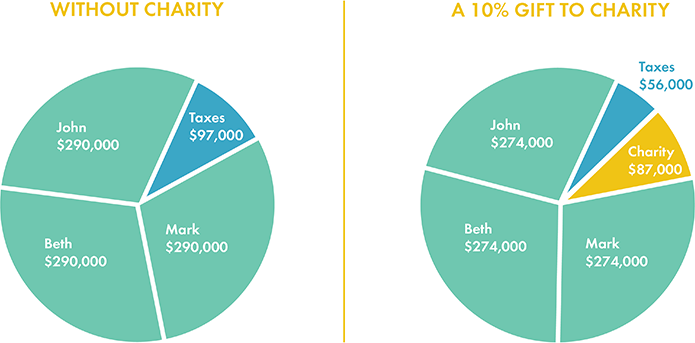

An Example of a Charitable Bequest

Note this is a fictional example, please consult with a financial advisor

Estimated value of the estate = $965,000 CAD

Potential tax bill on the estate = $97,000 CAD

Personal financial net worth= $868,000 CAD

Gabriella and Bill love their three children, John, Beth, and Mark, and want to ensure that they are left with equal shares of their estate. But they also love to support their favourite charity. On the left, Gabriella and Bill didn’t include a charitable bequest in their will. On the right, they decided to include a generous gift of 10% of their estate. In this case, a donor can support their favorite charity, while still being able to give generously to her three children.

*This illustration should not be constituted as tax or legal advice. Please consult your financial and legal advisors to discuss tax effective ways to make a charity part of your estate plan.

FAQs

-

What kind of impact will my legacy gift make?

A gift in your will may be the biggest gift of your life, and will enable you to support your favorite program or a city in a powerful way. Whether it’s supporting our many initiatives like the Family Housing build, employment or health and wellness services, you’ll help transform the lives of many people in the future.

If you’d like more information about leaving a gift in your will, please contact us at 1-833-GIV-HOPE (448-4673).

For examples of our client’s success stories, stories by our volunteers and more impact stories in our communities, please take a look through our blog here.

Click here to view videos of our clients and shelter guests that have been impacted by donors like you. -

How do I begin the process of leaving a legacy gift in my will?

Before leaving a gift in a will to my charity of choice, many choose to look after loved ones first. We recommend that you start asking yourself questions like:

• How much is enough for me?

• How much is enough for my heirs?

• How much is enough for my charity?Then you can consult your financial advisor to determine what type of legacy gifts will make the most sense for you. If you already have a will, and would like to include a gift to The Mustard Seed, you don’t have to rewrite your existing will. A simple addition – called a codicil – is all you need. Speak to your lawyer about how to add a codicil into your will.

-

Is there any benefit to estate planning for someone who is not really wealthy?

Most of the average person’s financial worth is in non-cash forms like RRSP assets, life insurance, house and vacation home for example and that some of these are the very things that create tax bills at the time of death. Even the most modest family can benefit from estate planning – and the charities they support as well.

-

How do I find an attorney?

Accountants, bankers, insurance agents, business owners, realtors, and other trusted business people may be able to help you with a referral. Your Pastor may know a qualified estate planning attorney as well.

Contact us to see if we can help with an attorney referral near you. Contact our Legacy giving Specialist at 1-833-GIV-HOPE (448-4673) or [email protected].

For more information:

1-833-GIV-HOPE (448-4673)

[email protected]

Your legacy gift ensures that hope will always endure. It’s one of the most important things you can do for not only your future, but the future of countless others.

Everyone has a story to share and a legacy to leave – what will yours be?

Registered Charity Number 87453 2518 RR0001